Ukraine’s reliance on Elon Musk’s Starlink satellite internet system has been vital for military and civilian communications. However, growing concerns over the possibility of Ukraine losing access to Starlink have fueled investor interest in Eutelsat, Starlink’s smaller European rival.

Since the February 28 public standoff between Ukrainian President Volodymyr Zelenskyy and U.S. President Donald Trump, Eutelsat’s stock price has quadrupled, signaling increased confidence in alternative satellite providers.

How Crucial is Starlink to Ukraine?

Starlink enables users to access the internet via satellite, using small dishes that connect to a constellation of low Earth orbit (LEO) satellites.

Since Russia’s 2022 invasion, Ukraine’s mobile and fixed-line networks have suffered severe damage from bombings. Starlink has filled this gap by deploying tens of thousands of terminals, supporting both military and civilian communications.

• Military Use: Starlink is heavily integrated into Ukraine’s battlefield operations, allowing units to coordinate attacks and evade Russian jamming.

• Drone Warfare: Ukraine previously used Starlink to guide attack drones, but SpaceX later restricted this functionality in 2023.

• Civilian Use: Some terminals are distributed for public use, enabling families to stay connected despite disrupted infrastructure.

Initially, SpaceX funded Starlink’s deployment in Ukraine, but later, the U.S. government and Poland took over payments. Poland recently reaffirmed its commitment to covering Ukraine’s Starlink costs.

How Does Eutelsat Compare to Starlink?

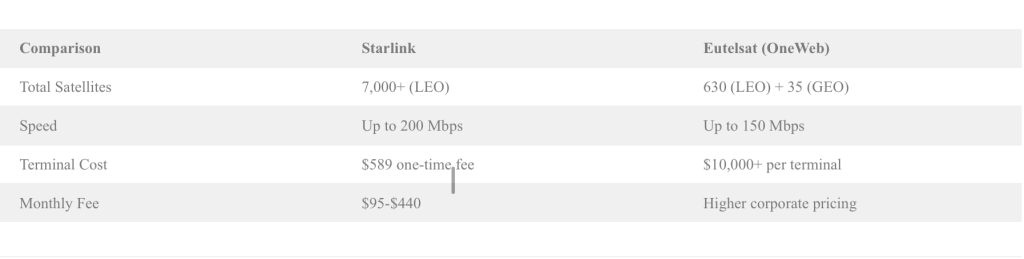

Eutelsat, which merged with Britain’s OneWeb in 2023, operates the only other global LEO satellite network besides Starlink.

While Starlink has a larger satellite fleet and higher speeds, Eutelsat argues that its hybrid LEO-GEO network provides similar performance in Europe. However, Eutelsat’s OneWeb terminals are significantly more expensive than Starlink’s, making affordability a key concern.

Are There Other Alternatives?

Other satellite operators serve military and corporate customers but do not offer the same direct-to-consumer services as Starlink:

- SES (Luxembourg-based): Provides satellite communications to NATO through its O3b mPOWER constellation in medium Earth orbit (MEO).

- Government-Focused Services: SES prioritizes corporate and military clients rather than direct consumer solutions.

Psst… here’s a pro tip! If Ukraine is forced to transition away from Starlink, expect governments and military alliances to play a larger role in securing alternative secure satellite communication networks.

What’s Next?

With geopolitical tensions rising, Ukraine’s continued access to Starlink remains uncertain. Meanwhile, investors are closely watching Eutelsat as a possible alternative, despite higher costs and fewer satellites.

The outcome of this situation will not only affect Ukraine’s battlefield strategy but could also reshape the future of global satellite communications.